wa state long term care payroll tax opt out

There is a small window to opt out of this premium payroll deduction by proving that I have my own long term care insurance- potentially an exemption period that will be shortened. However the said payroll tax is pending release as we wait for additional.

Long Term Care Income Tax Put On Hold By Gov Jay Inslee Clarkcountytoday Com

Opting back in is not an option provided in current law.

. For now those who have private LTCI can apply to opt out of the state program and payroll tax by following the steps below. 1 to escape new payroll tax. Go to an apply for an exemption button near the bottom of the exemptions page of the WA Cares Fund website.

If there are three points that indicate an employee can opt out of the Program and its taxes and benefits as indicated on the exemption form. You will not need to submit proof of coverage when applying. The employee must provide proof of their ESD exemption to their employer before the employer can waive.

Age 18 residency and insurance status for long-term care. The State has strict guidelines that private Long Term Care policy must include in order to qualify for the exception. Before we outline the process lets review some details about the new WA Cares Fund.

Click it and follow the directions on. Washington workers have until Nov. Individuals who have private long-term care insurance may opt-out.

The Long Term Care Trust Act included a provision allowing people to opt out of paying the 058 payroll tax as long as they could show they had other long-term care insurance in place as of Nov. If you buy private long-term care insurance before November 1 2021 and your private insurance is qualified you can get out of the public program. I strongly opposed this new state mandate and I want to make sure Washington.

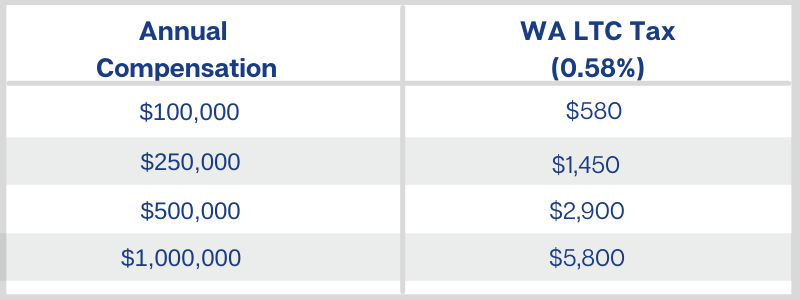

How do I file an exemption to opt out. As currently structured Washington workers will pay a 058 payroll tax on every 100 earned to fund a WA Cares individual lifetime benefit of. 1 to opt out of the states long-term care program which will help pay for nursing care and other support services for people who can no longer care for.

This program will help provide long-term care to your eligible employees. The premiums are paid by your employees through a 058 payroll tax starting January 1 2022. Workers already approved for a permanent WA Cares exemption because they hold a long-term care insurance plan do not need to reapply.

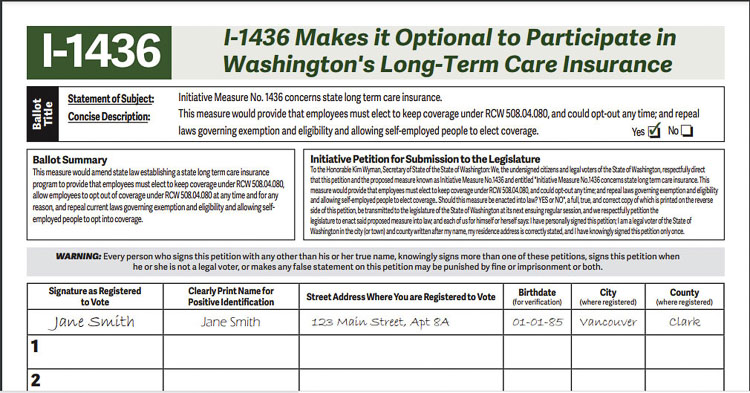

This alert summarizes the current state of the law resulting from final amendments adopted by the. A bill that moves up the deadline for employees to opt out of the states upcoming long-term services and supports program and its associated payroll taxes is on its way to the Governor. AWC partnered with other organizations and employers to successfully push back the opt-out date to November 1 2021 to allow employees more time to consider their long-term.

Get a Free Quote. November 1 2021 is the deadline to avoid the new tax by purchasing a private long term care policy. Due to the overwhelming demand for LTC insurance in Washington policies likely will no longer be issued in time to meet the states November 1 2021 deadline.

Employers will refund any premiums collected in 2022 so far. The new mandate burdens family budgets makes false promises and takes away choices. This is a permanent opt-out once out you cannot opt back in.

Can You Opt Out Of Washington State Long-Term Care Tax. Dear friends and neighbors A new payroll tax for a state long-term care insurance program will soon go into effect the result of legislation approved by the Legislatures majority party. The most significant legislative change is additional time for employees to opt out of the public program.

If you want to opt out of a payroll tax that begins in January assessed to fund a state-run one-size-fits-all long-term-care-insurance fund that you might or might not benefit from read more about the coming tax on our Center for Health Care blog here is what we know. Washington state is implementing a new 58 payroll tax on all W-2 employees who work in-state. Washington State Legislature established a long-term care insurance benefit known as WA Cares Fund.

A taxpremium of 0058 of wages to pay into a long term care Washington State program fund is set to commence Jan 1 2022 for all employees who receive W-2 income. You must purchase your own policy prior to November 1 2021 to opt out of this payroll tax. If you buy long-term care insurance before November 1 2021 you can get an exemption from.

Washington residents have one chance to get out of the public long-term care program. Opt-out option for Washingtons long-term care tax begins Oct. Recent changes to Washington State law will require employees to acquire long-term care insurance by November 1 2021 to avoid additional payroll taxes.

Already more than 470000 Washingtonians representing more than a third of the states payroll have requested to opt out of the program after. Washington State Long-Term Care Tax Opt-Out. First to opt out you need private qualifying long term care coverage in force before November 1 2021.

In order for the Washington state to allow you an exception to payment of the payroll tax and allow you to opt out of the States Long Term Care plan you will need to show them information about your private policy that is in force prior to your opt out request. Workers will begin contributing to the fund in July 2023. An employee tax for Washingtons new long-term care benefits starts in January.

Workers who live out of state and work in Washington military spouses workers on non-immigrant visas and certain veterans with disabilities will be able to opt out of the program if they choose. The WA Cares Fund. The State of Washington has now opened their online opt-out procedure for those who have qualifying Long-Term Care Insurance and wish to be exempt from the upcoming payroll tax.

Any employee who attests that they have comparable long-term care insurance purchased before November 1 2021 may apply to ESD for an exemption from the premium assessment. The date has arrived. Do Employees have the right to opt out of the program.

Washington State is accepting exemption applications between October 1 2021-December 31 2022. 1 2023 exemptions granted to military spouses non-immigrant visa holders and those living outside Washington will not be permanent. WA Cares Fund is a long-term care insurance tax of 058 of gross wages of workers in the state of Washington.

You need to already have or purchase a long-term-care plan through a private insurer by. Washington residents must enroll in private insurance by Nov. This new fund was created by the State Legislature to.

But if you want to opt out you may have some.

Washington Long Term Care Tax How To Opt Out To Avoid Taxes

Wa Cares Exemption How To Opt Out Of The Tax Brighton Jones

Washington State Long Term Care Tax Here S How To Opt Out

New Wa Long Term Care Tax Delayed So Legislature Can Fix It Crosscut

.jpg?width=565&name=WA%20Trust%20Act%20Tax%20(based%20on%20salary).jpg)

The Private Ltc Insurance Option For Washington State Workers

Kuow Washington House Votes To Delay Long Term Care Tax For 18 Months

Kuow Want To Opt Out Of Washington S New Long Term Care Tax Good Luck Getting A Private Policy In Time

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Despite Reports Washington S Long Term Care Tax Could Start Jan 1

Washington State Long Term Care Tax Avier Wealth Advisors

Washington State Trust Act Should You Opt Out Buddyins

Ltca Long Term Care Trust Act Worth The Cost

The Washington State Long Term Care Trust Act Opt Out Is Now Available Online Parker Smith Feek Business Insurance Employee Benefits Surety

How Do You Opt Out Of Washington State S Long Term Care Tax Youtube

What To Know Washington State S Long Term Care Insurance

Long Term Care Income Tax Put On Hold By Gov Jay Inslee Clarkcountytoday Com

Answers To Your Questions On The New Washington Cares Fund And The Long Term Care Payroll Tax The Seattle Times

Updated Get Ready For Washington State S New Long Term Care Program Sequoia

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management